Why Has Italy Turned Back to Berlusconi?

Many Italians have shown themselves happy to vote once again for a leathery old rogue...

GOLD UP, markets down earlier today. We haven't been able to say that in a long time, says Greg Canavan at the Daily Reckoning Australia.

Overnight, markets tumbled on concerns over indecisive elections in Italy. The thought of Silvio Berlusconi getting back behind the wheel of the Italian government is a truly frightening one for speculators (we've given up using the word investor, it's an anachronism). It should be a frightening one for Italians too. But sometimes if you ask, you shall receive.

Italians have had a taste of austerity, or living within their means, and they don't like it. They want Berlusconi and his bunga bunga parties back. They want good times. You can't blame them really. The battle between any society, at its core, is a battle between the forces of deflation, austerity and probity versus the forces of inflation, easy money, and profligacy. Usually, inflation and easy money emerge victorious.

But in Europe they're trying something different. The Euro, a sort of gold standard, is exerting discipline on its constituent countries. And it's working to some extent...if by working we mean getting countries' finances in order. Last year, Greece's current account narrowed by 73% to 5.6 billion Euros, the lowest since it joined the Eurozone. Greek society has taken an almighty hit to achieve this result, though.

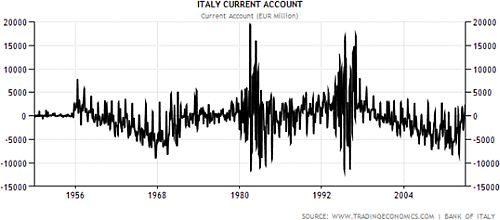

In Italy's economy, things are looking better...sort of. Its current account recently went into surplus. Basically, that means it has more incomings than outgoings. Judging by the current account's long term trend (see graph below), Italy is in pretty good shape. But it's the government that is the problem, not the private sector.

Italy's government debt-to-GDP ratio is 126%. Total government debt is €2 trillion. It cost €80 billion to service that debt last year. The way debt dynamics work, if Italy can't grow faster than the interest on the debt (around 4.5% currently) the debt-to-GDP ratio gets worse.

Austerity, then, is the only way of chipping away at the debt problem. If the government can run a budget surplus, it helps with the debt dynamics. But people don't like it when a government stops redistributing wealth in a way they've grown accustomed to, even if it really can't afford to keep doing so.

So they yearn for old times...the times that got them into the hole in the first place...and demand the return of old, leathery, charismatic rogues like Berlusconi. Talk about a rock and a hard place!

What the Italians are really asking for is their currency, the Lira, back. Austerity is a policy requirement to stay in the 'hard' currency area of the Euro. Under a Lira, Italy would have monetary independence and could set for a course of inflation and 'good times', rather than deflation and austerity.

Of course it's not as easy as that. If Italy left the Euro it would need to do something about the €2 trillion government debt pile, like renege on it or convert it to Lira. In which case interest rates would skyrocket and the country would lose the ability to borrow in the capital markets. Then the current account surplus would come in handy, as Italy would have to support itself.

What about gold? According to official figures, Italy has the third largest official stash of gold in the world, a handy 2,450 tonnes. Couldn't they sell some of that to get rid of their debt? It went up last night, so it would be worth more than it was yesterday...

Rounding up to US$1,600 an ounce, Italy's gold 'hoard' is worth a whopping US$138 billion, or €105 billion Euros. Gee, they could sell all their gold and reduce their debt by...5%. No wonder Italy isn't selling an ounce. Gold is far too cheap to sell at these levels.

At US$10,000 an ounce, Italy's official reserves would only be worth US$863.6 billion, or around €660 billion Euros, which is only 33% of its government debt.

The point is that gold is cheap at these levels. Ridiculously cheap. It may get cheaper in the short term, who knows, but the long term upside potential is enormous.

Are there any parallels between Italy and Australia? We have an election coming up and a sorry choice before us. Government debt is increasing but from a very low base. And our economic growth rate is strong enough to keep a lid on the 'debt-to-GDP ratio'. So we don't have any government debt issues that markets are likely to disapprove of.

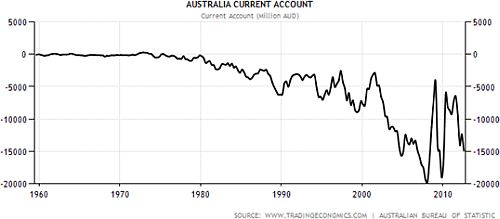

But our private sector competitiveness is much worse than Italy's. That is, our outgoings are much greater than our incomings. To make up the difference, we go further into private debt.

It's been this way for years, as you can see in the chart below. That's why no one worries about it and no self-respecting economist raises it as an issue anymore. Always and forever thus...

The China/iron ore/coal boom caused quite a bit of volatility in the last few years as massive price increases for select pieces of dirt improved our financial position. Then, big price falls saw the improvement vanish. Now we're back to relying on rather large imports of foreign capital to plug the hole.

We're not a part of a currency block so austerity is not something we have to worry about just yet. And in an election year, no government is going to promise that it will hand out less money than what it's already doing.

Which leaves us with interest rates and currency wars. The one thing that has kept foreign capital flowing into Australia is that we're not actively engaging in currency wars. Global capital seeks refuge here from Abenomics, the specter of Berlusconi and the Bank of England's mis-management of the Pound.

Australia has not yet got to a point where our economy is so bad that we need sub-2% interest rates and more government spending to prop it up.

But if China goes the way we expect (in a deep hole once it's bursting credit bubble craters the economy) then Australia will join in the currency wars and try to get the Aussie Dollar back down to more 'normal' levels. That will have a whole bunch of implications...

Buying gold? Get it safer, cheaper and easier with BullionVault...

Email us

Email us