Where the Wild Cats Howl, Part II

Only investment bears read history. The shills and shysters are too busy making money...

The INVESTMENT TRUST MANUAL for 1928 "was a little book," reports Robert L.Smitley in his Popular Financial Delusions.

As the Dow Jones then doubled by mid-'29, the trusts themselves were allowed to float as equity investments on the New York Stock Exchange, and so the next issue "was a big book. The issue for 1930 was a very big one.

But "that for 1931 was quite a bit smaller. For 1932 it was smaller than for 1928, and in 1933 it did not even go through the printer's hands."

The pace of this growth, and the horrors of its collapse, stood as a warning for almost six decades – a warning to future bankers, speculators, financiers and, most crucially, policy-makers. Buying the stock of a trust which exists solely to buy stocks worked wonders on the way up. On the way down, however, "it would be hard to imagine a corporate system better designed to continue and accentuate a deflationary cycle," as J.K.Galbraith wrote in his history, The Great Crash, 1929, a quarter-century later.

The gains had multiplied fastest when investment trusts starting buying each other's stock. Rising stocks begat rising stocks! And with investment-trust gains as easy as the credit which fed them, "there was no bank clerk, no stock exchange employee, no student of finance who did not honestly believe," Smitley goes on, "that he was capable of forming and managing an investment trust.

"This delusion...threatened to denude all other businesses of executives and employees. It decimated the teaching staffs of the economic departments of the universities until the drama departments found it necessary to double with the economic."

Sounds familiar, no...?

"We look at young, unproven managers, because we view new funds as having superior risk/reward opportunities than older, proven ones," claimed one New York fund-of-hedge-funds manager in Jan. 2006.

"Our ideal guy is in his early 30s, has been in the business for 10 years, but hasn't made his big money yet."

The ideal hedge-fund manager, in other words, was only just out of college when the Asian Crisis hit in the mid-90s. He was sneaking blunts behind the school bike-shed on Black Monday 1987. He was still in diapers when the S&P lost half its value between Jan. 1973 and Oct. '74.

"Yeah, him. Get me that guy..."

This bubble in idiocy soon brought in the hucksters and shysters, along with back-office support you could set up online! "Starting your own hedge fund is easy," as flashing banner ads claimed by the start of 2006. But the strategy of picking unproven, untested management also had detailed academic research to support it. Seriously.

A hedge fund manager's best performance, said a study of 1999, came during his early years. Performance then waned as success brought in more cash, said a study of 2001. "Good performers in a given year experience significantly larger money-flows in the subsequent year," said yet another study, "[but] larger hedge funds with greater inflows are associated with worse performance in the future, a result consistent with decreasing returns to scale."

Not even a kindergarten of nappy-clad fund managers could guarantee out-sized gains come what may, however, and the surprise Dollar rally of 2005 helped force over 850 funds to the wall. What's more, evidence also stacked up to show how investing with these lightly-regulated, highly-geared novices really did increase your odds of losing money.

"Who'd have thought it...?"

Back in 2001, a report from Bing Liang (now associate professor of finance at Isenberg School of Management, University of Massachusetts-Amherst) studied 2,000 hedge funds in business during the 1990s. Roughly one-in-four had ceased trading by July '99, but allowing for the "survivorship bias" in the data from those funds still standing, Liang found that:

- Hedge funds on average underperformed the S&P 500 index (14.2% growth per year vs. 18.8% from just buying and holding US stocks);

- They tended to blow up just when you needed them not to, most spectacularly during 1997-98, when the Asian Crisis morphed into the Russian Default and then the collapse of Long-Term Capital Management, briefly denting the "irrational exuberance" of stock investors banking that Alan Greenspan would always bail them out with low interest rates.

Further study by other analysts also noted that "hedge funds are more volatile than both mutual funds and market indices...The industry is characterized by high attrition rates...and little evidence of differential manager skill...[Only] about 25% of hedge funds earn positive excess returns..."

Still, the going was great when the getting was good, and like any self-respecting investment mania, the hedge-fund industry was also fast-gaining its own Investment Trust Manual...updated for the 21st century as a newsstand-worth of weekly newsletters, monthly magazines and daily stories online.

"The hedge fund industry has grown at a ferocious pace in the last decade," gushed HedgeCo.net at the start of 2006, "from as few as 300 funds in 1990 to more than 8,000 today. The funds have become highly visible in markets and press, and are today estimated to manage up to $1 trillion in capital."

Never mind those 850 funds which had folded in 2005, as Fortune reported, because some 2,100 new hedge funds opened. Just compare that to the outstanding total of only 600 funds ten years before...and then just think of the growth in fees (and sales of Patek Philippe watches) to 2008, by when – according to Hedge Fund Research – the industry was running more than $1.93 trillion across some 10,200 different offerings.

"Hedge funds," said HedgeCo.net as new start-ups exploded, "like other alternative investments such as real estate and private equity, are thought to provide returns that are uncorrelated with traditional investments...Investing in hedge funds," in short, "can further diversify portfolios and produce higher returns at lower risk."

Or rather, they could, back when they seemed to.

The disaster now striking the lightly regulated, highly geared portfolios of both wild-cat and old-hand hedge funds is very much of their own making. (See what happened to those Hedge Funds Shorting VW here, for example...) "In a fairly Darwinian manner, many hedge funds will [now] simply disappear," reckons Manny Roman, co-chief of GLG Partners. One of the very largest hedge funds around, it listed on the NYSE in mid-2007 at a price just shy of $10 a share. Last month, Oct. 2008, it slumped to $2.72...down 82% from its all-time peak of November last year.

No doubt applying an insider's insight, GLG's Roman says the sector will now shed one-third of its size before the blood-letting is done. Of those funds running $100 million or less, some 80% will go kaput says Alexander Ineichen, a member of the US Alternative Investment Management Association. He reckons a further 30% to 40% of mid-sized funds will also vanish. Already in the first half of '08, says HFR.com, 350 funds met their death. "At the current rate," says the FT, a total of 700 funds will close by year-end, around 7% of the industry."

Whatever went wrong?

"Pressure on hedge funds is mounting from every vantage point," wails one practitioner to the Financial Times. "Selling begets further selling and everyone is deleveraging".

"Banks are withdrawing capital from us," moans another. "They are simply not lending." Which is true for us all, of course – but without quite killing us as quickly as tight money destroys highly-geared hedge funds.

Blowing air into the hedge-fund bubble of 2000-2007, you won't be surprised to learn, were the big investment banks.

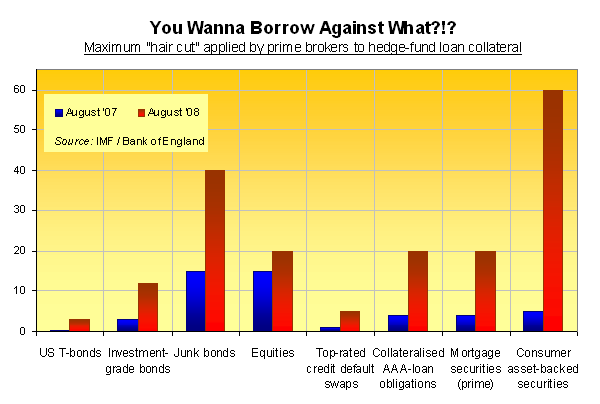

Acting as "prime brokers" to wild-cats and old-hands alike, Wall Street's finest offered to deal whatever the hedge funds felt they might need. They also provided long ropes of credit, but only for as long as the hedge funds kept making money – and only for as long as the assets they posted as new loan collateral kept hold of its value. When the door slammed shut on cheap credit in mid-August 2007 – and the value of more exotic hedge-fund collateral collapsed in the crunch – the brokers called in their loans and closed-out the trades. If you wanted to make a new leveraged bet, it would cost you, and cost you dear, thanks to the "hair cut" applied to whatever existing assets you put up as your prime-broker's security.

"It becomes a vicious circle," says one hedge fund chief, "and in illiquid markets...it is a huge crisis." By August '08, even a hedge fund putting up US Treasury bonds as collateral could raise only 97% of their value as cash or new gearing. Compare that with 99.75% the same time last year.

The hair-cut on high-yield "junk" corporate bonds went from 10-15% to 40% inside 12 months, says data from the Bank of England. Asset-backed securities relying on consumers repaying their debt suffered an average hair-cut of 60% when used as collateral, up from just 5% in summer last year. Never mind that it was the investment banks themselves who created and sold the most exotic, alphabetized debt obligations – those CDOs of ABS. Whether triple-A rated or triple-B junk, they stopped accepting these "assets" altogether as collateral according to IMF data.

Any wonder global asset prices have sunk? "If the average hedge fund has two-times leverage," says one broker, "the industry may be forced to sell [another] $500 billion in assets between now and the end of the year." Because as the prime brokers recall their loans – and refuse to lend anything like the 'fair value' of assets put up as collateral – the leverage which paid so beautifully on the way up acts instead "to continue and accentuate a deflationary cycle," as J.K.Galbraith wrote of the 1929 crash.

Worse still, too many hedge funds keep making bad bets – first short Dollars and long Forints...then long of Icelandic banks and short Volkswagen...now geared up on Gold Futures (long, short or both!), then piling into Japan just in time for the next downward lurch.

Amid all the chaos, hard regulation is coming – regulation to surpass the Glass-Steagall Act of 1934, which effectively closed the investment trust business long after it mattered during the Great Depression. Specific laws on gearing, dealing and reporting also look likely to match restrictions on currency trading in both Asia and the US.

Oh, and then there's Obama.

"Among the bills Obama sponsored during his time in the Senate," reports FinancialNews.com, "was one that would have required hedge fund managers to set up anti-money laundering programs supervised by the Treasury Department. Just last week, the Treasury abandoned a similar proposal, but one of the Obama bill's co-sponsors promises that the president-elect will take up the issue once he is in the White House."

Hedge funds are "an unlikely choice of vehicle for money laundering or terrorist financing," pleads Hedge Week, "because of their risk profile and relative lack of liquidity." But the new president-elect has also backed plans to close tax loopholes that hedge funds and private equity managers have long exploited, reducing what little profit they turn further still.

Can't a guy get a break when he's leveraging other folks' money with other folks' credit and betting the lot on obscure derivatives?

"It may be that history does not repeat itself as a whole," wrote Robert Smitley in 1933's Popular Financial Delusions, "but in the particular field of investment trusts there is little doubt of such an analogy. The formers of these trusts had the whole history of the English debacle at their hands."

The English debacle? Starting in 1880, "the formations were based upon the diversification of risks, with the use of as many different units as possible, geographically distributed. But it was not long until the basic principle was forgotten. Later on, trusts were often formed as mere adjuncts to the firms and companies engaged in raising capital...and these unhappy new trusts were constituted the dumping ground for any portion of new issues not taken by the public.

"The owners of these trusts soon discovered that they were 'holding the bag'. The prices fell rapidly, the public lost confidence in them, and the word 'trust' became synonymous with the term deception. Scandals arose, the law courts were jammed with cases, and by late 1891 the whole structure toppled and fell."

Incredibly, the very same thing happened in New York less than forty years later. And again, but with the words "hedge fund" applied where the Investment Landfill was destined, another eight decades on.

Only bears read history, however. The bulls and their shills are too busy trying to make money.

Email us

Email us