"He Who Has the Gold..."

Emerging-market nations hoarded new gold reserves at a near-record pace in 2009...

SEEING WASHINGTON'S belligerence over how Beijing pegs the price of its Yuan, three unsettling facts are buried amongst the latest central-bank gold data compiled by the World Gold Council...

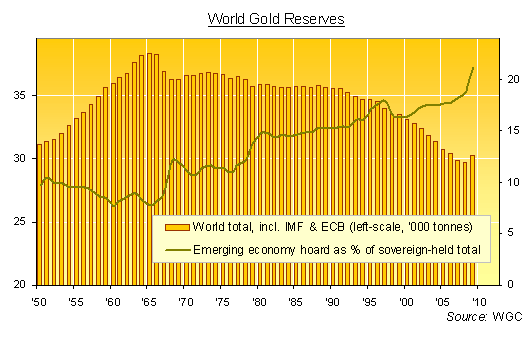

- Central banks worldwide grew their physical gold reserves at the fastest pace since 1965 in 2009, adding bullion for the first time in two decades as a group;

- Emerging economies added a near-record volume of metal to their official reserves, putting more than 21% of all the gold held by sovereign states outside the control of developed-world OECD members;

- Western central banks, in contrast, shrank their reserves by more than 1% last year. Since the end of 2004, they have sold almost twice-as-much gold as non-OECD members have acquired (1881 vs. 994 tonnes).

As the gold-bug's Golden Rule says, "He who has the gold makes the rules" – an historic fact proven by the United States' own dominance of world finance and politics since the end of WWII.

And now that Congress is threatening trade sanctions against China for under-valuing its currency, the Yuan, Washington might want to take note of how its Dollar came to be the world's No.1 currency.

Last year marked a "changing pattern" says the World Gold Council, pointing to slower West European sales and "accelerating" purchases by emerging-economy states.

But even noting Moscow's frantic expansion of its gold reserves – primarily bought from domestic mine output, and taking Russia to 9th position in the sovereign league table – the WGC's comments underplay the deeper, political shift of monetary intent, if not power.

In full-year 2009, emerging-economy states grew their reported reserves by 17.8%, adding 868 tonnes of bullion to build a new record hoard of 5738 tonnes. Yes, China's announcement in April that it had added 454 tonnes to its reserves over the previous six years accounted for a big chunk of that move. But Beijing and the Kremlin weren't alone in Buying Gold. By the end of 2009, non-OECD members held half-as-much gold again as they did on average over the previous six decades.

Trying to force fresh Dollar-devaluation on today's Treasury bond holders is only likely to spur this underlying trend still further.

Email us

Email us