Gold Stocks: Sell in May?

With Gold Prices volatile after the mid-March peak, junior gold mining stocks are down 50% and more...

SO HERE WE ARE in May '08, and everyone's asking the question, says John Lee of GoldMau.com.

Is it time to sell and walk way?

The answer depends on what you are holding. But let's focus on timing Gold Investment via the junior gold mining stocks. We'll use the S&P/TSX Ventures Composite Index as a proxy.

Junior Gold Stocks: Resource Junior Roller Coaster

Over half of our fund's portfolio of fifty and more junior resource stocks are now trading 50% below their peaks. I suspect many other junior resource investors are in the same boat.

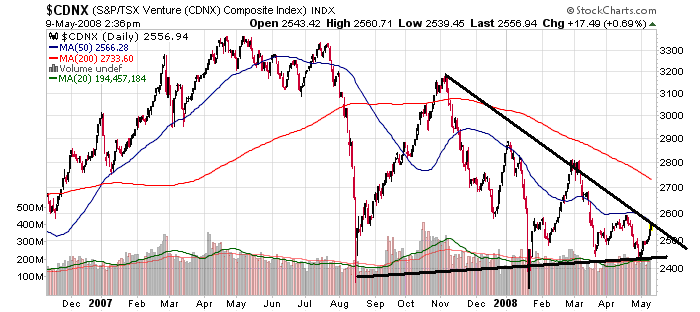

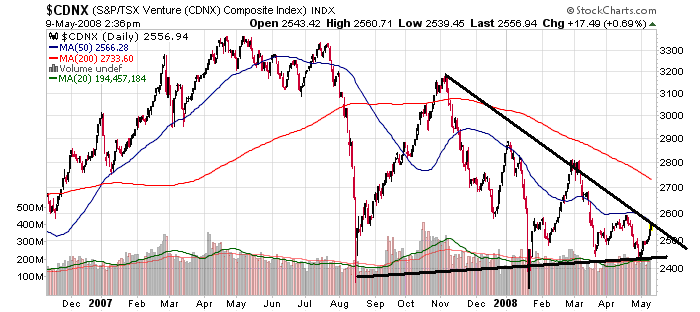

Indeed, despite both oil and Gold Trading at all-time record highs, the TSX Ventures Composite Index ("Ventures Index") is trading near its two-year low.

Investing in juniors in the past two years has not been for the faint-of-heart and the Ventures Index has made several round-trips between 3,300 and 2,500, highlighted by a stunning and record 33% drop last August.

Does it make sense for junior gold miners and oil stocks to come off so hard?

Junior Gold Stocks: Oil & Gold Prices

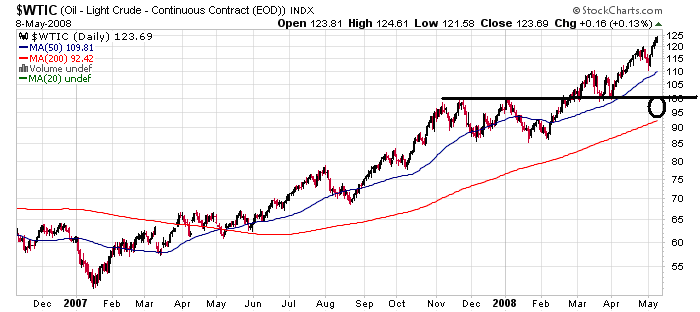

I have heard oil bears talking of a big correction since oil was way back at $40 per barrel. So while I can't tell you where oil is going today, the chance of it ever going below $100 is diminishing rapidly by the day.

The crude oil chart now indicates strong support at the 200 day moving average (DMA), which is at $95 and rising.

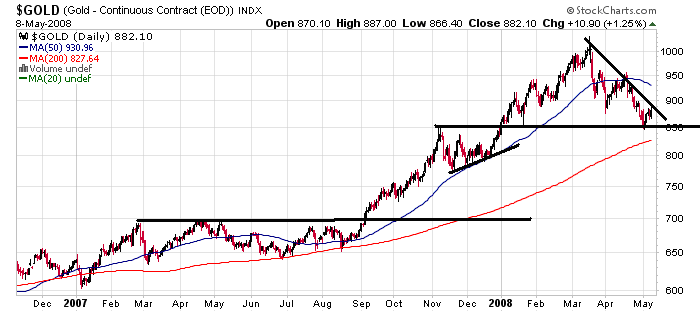

Gold has been a laggard relative to oil. The Gold Price is currently sitting around $880 per ounce, and the chart indicates good support at $850, its old 1980 high. There's also likely to be support at its 200 DMA of $830, which continues to rise.

We project the next leg up for the Gold Market later this year will be to take out $1,000 per ounce with ease.

So what to make of the junior resource sector – in particular, junior gold miners?

Junior Gold Shares: Buy or Sell?

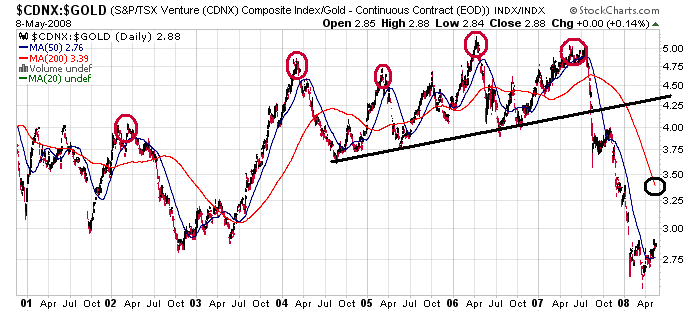

Let's take a look at a chart of the Ventures Index divided by the Gold Price. This ratio indicates the relative value of junior mining shares compared to the price of gold.

As the chart indicates, resource equity investors did well by selling in April of 2002, 2004, 2005, 2006 and 2007 (red circles). Is selling resource stocks the right move again in spring 2008?

One might think so. But this chart – of junior gold stocks relative to the Gold Price itself – is sitting at 7-year lows. Now trading cheaper than at any time since the bull market began in 2001, the Ventures index looks cheap to me, with very low risk, unless oil and gold crash 30% in the next two months.

Back on April 8th, I published an article titled "The Start of the Run for Gold Shares"

In it, I wrote that "it makes no sense for the American mortgage crisis to impact Canadian gold and resource juniors. One can now margin at 5% to buy oil trusts paying 15% dividend and gold juniors for less than $10/oz in the ground.

"I am confident the situation will reverse, offset not by higher interest rates but by higher junior stock prices. Within two months and as soon as we hit the bottom of interest rates, I expect all the hoarded money to spill out looking for a new home as it simply does not pay to park money earning 2% with real inflation running at double digits."

Now a month and another US interest cut later, we are indeed seeing revival of the Ventures Index and I expect it to break out of 2,500 level to test 200 DMA of 2,750 shortly.

Email us

Email us