Nothing Good About Inflation

Wheat prices are acting like it's 1974 and the Dollar has just been de-coupled from gold...

POOR HAMLET – he was so confused.

"There is nothing either good or bad, but thinking makes it so,"

he tells Rosencrantz and Guildenstern in Act II. But a fist to the face

does not become a ticklish feather merely because you think it so.

The Danish prince did have a point about perception, however.

Two investors can look at the same objective fact – such as rising Gold

Prices, for instance – and because we human beings perceive the world

subjectively through our own experiences and prejudices, they can then

reach opposite conclusions.

Take the battle with inflation now raging at the Reserve Bank of

Australia. This week it made public the notes from its Feb. 5th meeting

in Sydney. And though the report was full of hawkish language about

inflation and the need to reduce strong domestic demand, investors

chose to focus instead on the "strong economy" language and not the

"higher inflation" language. So Aussie stocks rallied.

Inflation is bad. Thinking otherwise doesn't make it so. The RBA

recognizes the trouble in global financial markets, but added in its

notes that "the main risk was that demand would still prove to be too

strong to allow a decline in inflation over a reasonable time period."

The RBA board members "therefore concluded that the outlook for

inflation required an immediate response from monetary policy. The

debate focused on whether the change in the cash rate should be 25 or

50 basis points."

As you might know, the Reserve Bank settled for a 25 point rise,

with another March rise a near certainty. That might curb the borrowing

and spending habits of Aussies. But when it comes to food inflation and

fuel inflation, is there much the Reserve Bank can do about rising

world prices?

Crude oil has closed up nearly 5% in New York trade to cross the

$100 barrier once again. Oil is up 9% on the year and 72% from the same

time last year, but the nominal high is still short of the

inflation-adjusted high in 1980 – suggesting there's further to go yet.

Oil hit $38 in 1980, which in today's ever-more-worthless US

Dollars is about $103 per barrel. Even so, oil's run has caught us a

bit off guard. We're long-term energy bulls here at The Daily Reckoning. But we reckoned slower global growth this year would curb crude demand and bring prices down to the low $80s.

We even thought speculators might cash in some chips and reduce

the investment demand for oil in the futures markets, bringing the

price down more.

We're wrong about that so far. Another oil refinery, this one in

Big Spring, Texas, has suffered an explosion. These refineries have

been running flat out for years, with virtually no down-time for

repairs. Breakdowns are bound to happen.

You also have continued geopolitical instability in Nigeria,

that moron Chavez in Venezuela, and OPEC threatening production cuts.

Concerns about supply have trumped prospects of global growth.

The upshot? Gold Prices were up $23 and trading above $940 in

after-hours access trade on the Comex Wednesday. Platinum slipped from

its new high at $2,174. And wheat? It's set a new record high 16 times

since September.

"The biggest rally in the history of wheat trading defied even

some of the best conventional wisdom, humbling forecasters Goldman

Sachs Group Inc. and the US government," reports Tony Dreibus at

Bloomberg.

Something strange is going on the agricultural markets. Food

inflation is here and prices are soaring. It's partly cyclical. It's

also partly monetary, as all dollar-denominated commodities react to a

weaker US Dollar and a flood of money worldwide.

But there's more to it. Wheat's moving like its 1974...

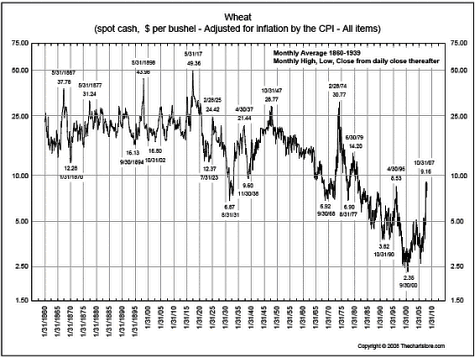

The chart above from my friends at TheChartStore.com shows spot wheat prices (per bushel) since 1860.

As you can see, wheat prices traded in a range for nearly

seventy years between 1860 and 1917. Industrialization and improvements

in agriculture infrastructure led to higher crop yields. But World War

Two put food production (and security) back on uncertain footing, even

leading to the Bengal famine of 1943, where some one million people

starved.

India became independent from Britain in 1947 and the postwar

era – combined with the Green Revolution in agriculture – led to

steadily declining wheat prices. But the exception was 1974, when

wheat, like all other dollar-denominated commodities, reacted to the

decoupling of the US Dollar from gold and the whole world enjoyed a

bear market in stocks alongside surging inflation.

Otherwise known as "stagflation", this combination of slowing

growth plus rising inflation left real interest rates way below zero.

Gold Prices shot higher.

Yet the long-term evidence shows that – up until very recently –

the price of raw materials including food has been going down for

nearly 150 years. Could it really be different today?

Are we now witnessing some sort of super cyclical tipping point

in food inflation, where prices will get more expensive – rather than

continuing to fall? Or is this just another 20th century inflationary

cycle, the kind that comes and goes?

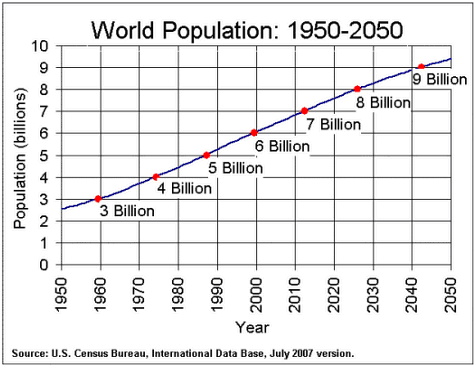

A clue to the answer lies in the chart below. True, central

banks today are inflating as they were in 1974. But there are also

about three billion more people on the planet today than there were the

last time soft commodities reacted to dollar weakness.

If you only look at the first chart, you'd think wheat would be due for

a correction, having basically matched its 1974, monetarily-motivated

move.

But will the current move prove bigger 34 years later...because the world

is a bigger, hungrier place today?

The Reserve Bank of Australia certainly can't do much about world

population growth, so perhaps it can't now put the food inflation genie

back into the bottle.

China reported that its consumer-price inflation rate ran at

7.1% in January. "Inflation is starting to hurt ordinary people in a

country where tens of millions live in poverty and as much of 50% of

household income is spent on groceries," reports Jane Macartney for The Times of London from Beijing.

"Food, which makes up one third of China's consumer basket, cost

18.2% more in January than a year earlier, after rising 16.7% in the

year to December. Many Chinese say that now they try to avoid pork

because the price of the staple meat for the country's 1.3 billion

people has soared 58.8% from January last year."

The upside for Western investors? Australia's terms of trade

look set to improve further if farm exports start to catch up with

mineral exports. What production of 13.1 million metric tons was up 23%

from last year, but is still down 39% from the five-year average.

And so far in Feb. 2008, the Aussie Dollar is the only major

currency to avoid a sharp decline in terms of Gold Bullion prices, too.

Can it continue to hold its ground even as Australian inflation keeps

rising?

If you can't beat inflation, you might want to back it instead. You certainly can't "think" it away.

Researching your first Gold Investment today? Don't pay more than you should! Make it simple, cheap & ultra-secure at BullionVault...

Email us

Email us