Timing Your Silver or Gold Investment

A statistical look at the best days of the month to make a silver or Gold Investment...

FIRST, let us look at the potential advantages of saving in gold and silver over Dollars. Here's a hypothetical look at what could occur over the remainder of this decade, writes Jeff Clark at Casey Research.

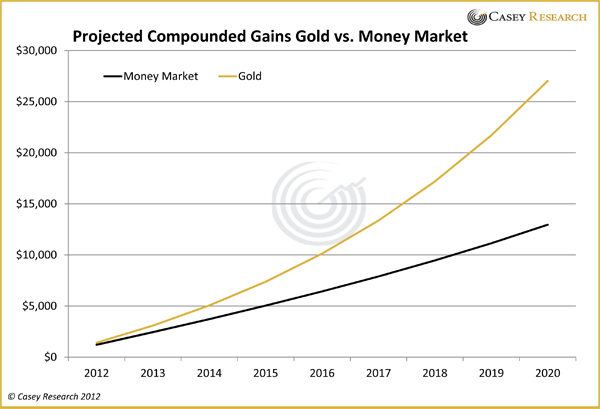

The charts below compare saving $100/month in gold and silver vs. an interest-bearing money-market account. For our projections, we assumed gold's average annual gain of 18% since 2001 will continue through 2020. For the money-market account, we used an annual interest rate of 1% in 2012 and added 0.5% each year, so that by 2020 it's earning 5%.

Here's what would transpire by 2020:

If you invested $100/month from January 2012 through December 2020, your total contributions would amount to $10,800. In the money-market account, your savings would compound to $12,959.48, for a gain of 20%. For gold, however, the value of the metal would reach $27,025, for a return of 150.2%.

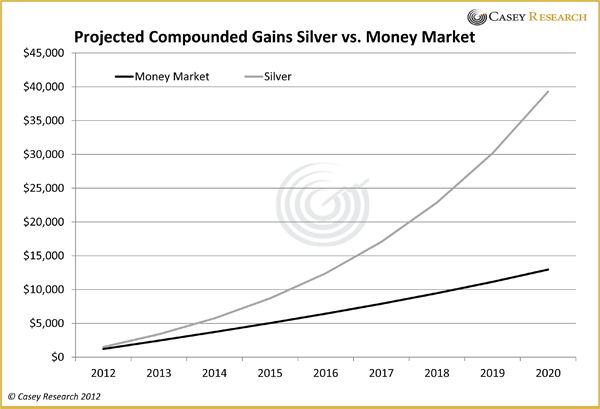

For silver, we'll assume it matches its 25.3% average annual gain from the last ten years through 2020. Here's how it would stack up against money saved in a money market account.

The money-market account would again gain 20%, but the value of silver would reach $39,302, for a total return of 263.9%.

[One thing to bear in mind about Silver Investment: the metal is much more volatile than gold, and has large industrial applications that could hinder the price in a poor economy. And if fear is high, gold will be sought before silver.]

As you consider these data, keep in mind the power of Dollar-cost averaging. Using this strategy to accumulate gold and silver will lower your cost basis automatically because you'll buy more ounces when prices are low and less when they're high. And that highlights another gain: Buying Gold and silver systematically removes emotion from the equation. "Buy on dips" is good advice, but it doesn't tell you exactly when to buy. A commitment to Dollar-cost averaging eliminates that question.

You may argue that interest rates will be higher later this decade, and you'll probably be right – but we offset that likelihood by excluding any mania in precious metals. Also, taxes must be considered, as rates are higher on capital gains for gold and silver than for passive income, yet you'd still be left with a much greater return.

At the risk of repeating ourselves, at this point, with the monetary and fiscal predicaments confronting many of the world's governments, and the probable responses they will employ, we recommend a good chunk of your savings be held in gold and silver.

If you're going to Dollar-cost average your purchases, it might be useful to know if there are days of the month that are better to buy than others.

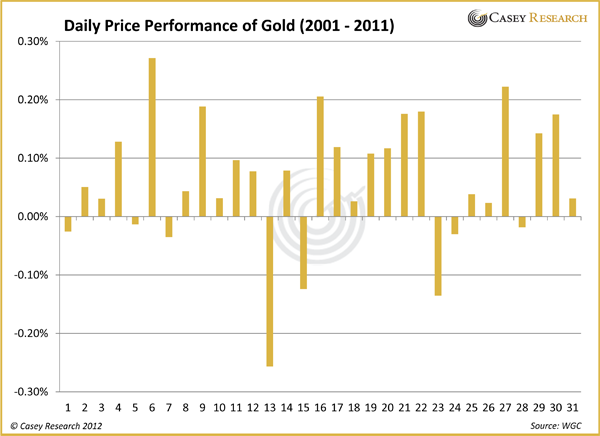

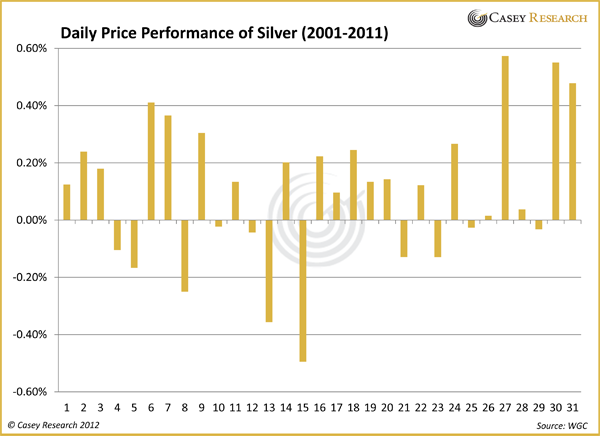

We measured the performance of both gold and silver for each day of the month from 2001 through 2011, and then calculated the average daily return.

Here's what we found for gold.

Clearly, the 13th, 15th, and 23rd are ideal days to buy since the price tends to be the weakest.

Here are the data for silver.

The 13th and 15th again stick out as good days to buy.

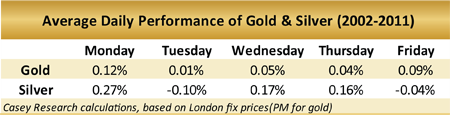

If you're accumulating on a weekly basis, we found Tuesday is the weakest and thus a good time to buy (as well as Friday for silver).

A few things to consider if you decide to use this information:

- The figures are averages, so there are days when prices bucked the trend. Do not view these results as certainties.

- These days might fall on weekends or holidays and so won't be available every month.

- The calculations use daily closing prices, which would be almost impossible for an investor to match.

- The results measure past performance and can't predict the future.

That said, if you arrange to buy gold on the 13th and silver on the 15th of each month – or on Tuesday for either metal if buying weekly – your cumulative gains, according to these historical data, stand a statistically greater probability of being slightly higher. Again, your mileage may vary.

Making a silver or Gold Investment? Buy Gold and Silver Bullion at the lowest possible cost when you buy on BullionVault...

Email us

Email us