Playing the Gold Price Averages in Summer 2012

Summer 2012 is sticking right to the typical Gold Price pattern so far...

IT'S A HARDY perennial for anyone studying the gold market, writes Adrian Ash at BullionVault. And with the British summer being more like November this year, very hardy perennials are just what is needed.

But will the Gold Price blossom on schedule?

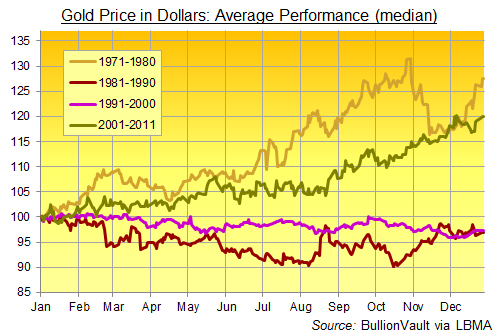

Greener than George Monbiot's socks, we're happy to recycle this fact yet again. The Gold Price tends to display a seasonal pattern – rising in spring, slipping or flat-lining in summer, only to rise once more in the fall and then winter.

No, the pattern was shot in 2011 as we noted last July. But such profitable "summer sales" have occurred most frequently during longer-term bull phases, as we told the Financial Times in 2009.

For Dollar investors, Buying Gold even at the highest price in July or August has only failed three time to deliver a gain by year's-end since this bull market began in 2001 (extending a pattern we noted in 2010. Lehman's collapse threw 2008 out of sync). Indeed, buying gold regardless of price in July or August has paid off 20 times in the last 44 years all told – and delivered an average 5.1% profit even with the losses included.

Now, this is hardly the way to time a serious move into gold. Buying regardless of price? Just because history says the summer average rewards it by year's end?

Viewed as crisis insurance, however, gold comes at a cost – your premium being the price you pay when you take out your policy. Sensible home economics says you should look for best value. Only here, cutting your premiums needn't void your insurance.

The Gold Price could well go cheaper from here. But if it doesn't, and people scramble once more for the security, liquidity and diversification only a lump of rare yellow metal can bring, then the current lull could be offering insurance at summer sale prices.

To date, this summer's lull is looking utterly typical so far.

Cut your costs further – get the safest gold at the lowest prices using world #1 online, BullionVault...

Email us

Email us