What Comes After a Trillion?

The $1.8 trillion question, answered by inflation...

JUST ABOUT A YEAR AGO, writes Eric Fry in the Rude Awakening, I asked our readers: "What comes after a trillion?"

Today we know the answer: two trillion...and then three...and then four. But in May of 2008, the answer was not as obvious as it is today. And so we wondered aloud, "How much is one trillion anyway?"

We can answer the question from a variety of perspectives. For example:

- One trillion seconds equals 31,546 years;

- One trillion Dollar bills placed end to end would reach 96.9 million miles, far enough to reach the sun;

- The average new car costs $28,400. $1 trillion would buy more than 35 million cars.

Why did we bother trying to quantify the sum, one trillion?

Because just a few weeks earlier, in spring 2008, the International Monetary Fund (IMF) had estimated that the global banking crisis would produce about $1 trillion of losses.

Shortly thereafter, then-President George Bush delivered America's first $3 trillion budget. Suddenly, the kind of arithmetic that required twelve zeros had become an exercise of national importance.

One year later, this exercise has become vastly more important. The IMF has doubled its estimate of banking sector losses to $2 trillion (while many private economists put the number between $3 and $4 trillion). Furthermore, the US government of 2009 does not merely count its budget in the trillions of Dollars, it counts its budget DEFICITS in the trillions of Dollars.

According to the latest estimates, President Obama's very first budget will produce a deficit of $1.8 trillion in 2010. And that's the OPTIMISTIC guess.

So where's the shock over this shocking development? Where's the awe? Where's the national outrage over the mind-numbing cost of bailing out Wall Street's self-serving speculators?

There isn't any. No shock. No awe. No outrage...and the reason is very simple: almost no one gets it...literally. The numbers are simply too large.

"The scale of what President Barack Obama proposes to do to the American economy is so enormous, so far-reaching and so potentially disastrous that the [Republican] party is having a hard time describing it," writes Byron York, chief political correspondent for the Washington Examiner.

"GOP message mavens are struggling with something that academics call 'insensitivity to scope'," York continues. "It affects us all; we can understand something on a small scale but have a difficult time comprehending the same thing on a massive scale. Insensitivity to scope is a major obstacle to understanding the Obama administration's $3.6 trillion 2010 budget. People simply have trouble understanding a number so big. A recent poll asked Americans how many millions are in a trillion. Twenty-one percent of respondents got the answer right – it's a million million. Most people thought it was a lot less."

So that means that four out of five respondents got the answer wrong...and most of them guessed too low. No wonder a $2 trillion deficit doesn't seem like a problem.

"[One GOP pollster] tries to explain it," York goes on, "by asking people to think of a Dollar as a second – one Dollar, one brief tick of your watch. A million seconds, the pollster explained, equals eleven days. A billion seconds equals 31 years. And a trillion seconds equals 310 centuries...After a review of the Obama budget's numbers before formal submission to Congress, Budget Director Peter Orszag said this year's deficit will be $1.841 trillion – $89 billion more than previously estimated. If you're listening to the ticks of your watch, that's about 570 centuries."

And let's not forget that the Obama budget assumes the economy will be growing at a 3.5% annual rate by the end of this year. That's a good number in good times. In bad times, such as we are now enduring, a 3.5% growth rate is nothing short of delusional. So we'd guess that the actual budget deficit is likely to be much larger than the already-large numbers the Obama camp is tossing around.

What does all this mean for investors? Hard to say exactly...but not that hard to say inexactly. This $1.8 trillion funding shortfall is a great big hole to fill. Indeed, it is a hole so large that tax receipts could not possibly fill it. Foreign capital and/or domestic savings could theoretically fill it. But in the real world, that's not likely – not at meager 3% and 4% rates of interest over ten to thirty years, such as currently offered by US Treasury bonds.

So the most probable "solution" to the funding shortfall is also the most expedient one: the government will buy bonds from itself.

This ancient remedy to fiscal imprudence used to go by the name of currency debasement. But today this process comports itself with an air of sophistication by wearing the title, "Quantitative Easing".

Different name; same result: inflation.

The financial markets are picking up the scent already.

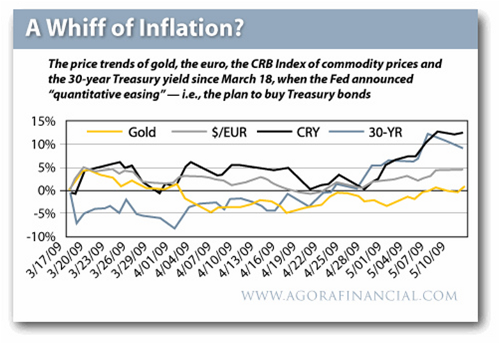

Ever since March 18th, when the Federal Reserve announced its intention to purchase $300 billion of Treasury debt, most financial markets began pricing in an inflationary threat. Gold Bullion, commodities and bond yields have been moving higher, while the Dollar's value has been moving lower.

"We are experiencing a deleveraging on a scale in the world that is absolutely breath-taking in its scope," warns John Mauldin, editor of Outside the Box, "And to balance that, governments are going to have to issue massive amounts of sovereign debt to deal with their deficits. But who will buy it, and at what price? And in which currency? Even though we can see the challenge, it is not clear what the final outcome will be, other than stressful volatility as the market reacts."

We're guessing the volatility will be much less stressful for those folks who hold a significant amount of their assets in Gold Bullion and commodities. And the stress might even morph into pleasure for gold-holders if – as we expect – the governments of the world enthusiastically pursue the stealth larceny of currency debasement along with the United States.

You can dress the debasement process in Harvard B-school jargon, surround it with Federal Reserve White Papers and re-christen it, "Quantitative Easing". But after all that, you've still got the same old process of currency debasement, which produces the same old results:

Inflation.

Email us

Email us