Famous Last Words

Two rules for spotting investment bubbles – and steering clear...

The FIRST RULE of investing? Warren Buffet says it's "Don't lose money," writes Dan Steinhart at Doug Casey's Casey Research.

Sound advice, but don't take it literally. Because all investors lose on occasion. Still, it is a worthy goal to aim for. And to have any chance of reaching it, you must learn how identify and avoid bubbles.

That is easier said than done. We've all seen that seductive sector that just keeps going up...and up...and up...coaxing in more and more unwitting investors along the way. At its peak, even the most strident skeptics concede that sky-high prices are the new industry norm. And then...POP!

In an effort to avoid such unpleasant situations, here are two rules to help you detect bubbles well before they harm your wallet.

Rule #1: Watch the Sectors

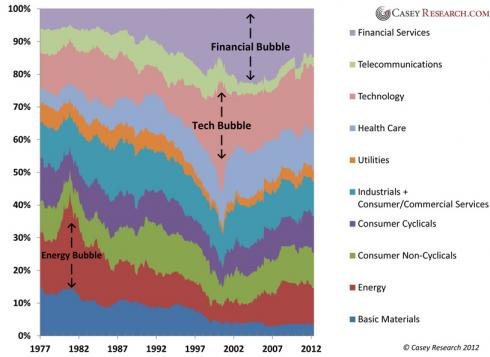

We use the Casey Research Bubble Monitor to sniff out bubbles as they inflate. Essentially, it compares the size of each S&P 500 sector against the others, and we observe the change over time.

This simple concept brings powerful results. Take a look:

The swells and pinches illustrate the various sectors growing or shrinking in relation to one another.

Bubbles are easy to spot – during each, the offending sector expands and encroaches upon the others.

At their peaks, as you can see, the energy, tech, and financial bubbles all claimed an unsustainably large chunk of the S&P 500. Hence the Bubble.

Casey's Bubble Monitor is based on the assertion that no one sector should comprise much more than 20% of a large, diverse economy – and the US economy is as large and diverse as they come.

A case in point: Tech, at its August 2000 peak, comprised 35% of the S&P 500. Predictably, it plummeted to just 15% in the ensuing years.

Indeed, whenever a sector strays too far too quickly from its long-term average, it always gets knocked back into line. The energy and tech bubbles ended with blow off tops, and crashed soon after. The financial bubble persisted longer, but also popped in epic fashion.

Today, the US economy is mostly well balanced. My only concern is that tech is beginning to look a little frothy, as it has climbed above the important 20% threshold in recent months. We'll be keeping a close watch on this situation, and if it starts to look seriously bubbly, will issue an early warning in The Casey Report.

Rule #2: Beware the phrase "This Time is Different"

A bubble begins with a paradigm shift – a totally new way of doing business that forever alters an industry's landscape. It destroys old opportunities and ushers in new ones. That creative destruction is the lifeblood of any healthy economy.

But paradigm shifts also have a dark side – they are oft used as justification for why bubbles are not really bubbles.

Think of the mass adoption of the internet in the late 1990s. An endless world of possibilities opened up overnight, and investors assumed that all companies connected to this phenomenon would rake in the dough. Stock prices soared as investors anticipated wild profits. The potential seemed limitless.

You know how that story ends.

We now look back at those 2000-ers with puzzlement. How did they not see the bubble? Did they not notice the chart of every dot-com company going parabolic?

Of course they did. But they rationalized it away with the paradigm shift: "Stock prices are booming because there's an entirely new industry! This isn't a bubble, because these high prices are actually justified!"

Or, in other words, "This time is different."

Famous last words. In a free(ish) economy, profits can explode temporarily when a new industry is born. But those swollen profits are quickly eroded by entrepreneurs entering the field. They find new, better, and cheaper ways to do things, then lower product prices to compete with each other. Before long, profit margins plummet toward equilibrium with all other industries. And sky-high stock prices can't persist without sky-high profit margins.

Don't join the lemmings in rationalizing ridiculous prices. Sky-high prices = bubble. And all bubbles end the same – with a pop.

You can spot when individual sectors are overvalued. But how do you know if the stock market as a whole is over- or under-valued?

As educational reading, our chief economist here at Casey Research, Bud Conrad, has just completed a free report. In it Bud employs three highly accurate indicators to determine whether US stocks are expensive, cheap, or reasonably priced.

Without spoiling his conclusion in this report, Stocks vs. Bonds, all three indicators strongly point in the same direction today – a fact you'll want to consider when deciding where to invest your money for the rest of 2012 and into 2013.

Get the safest gold at the lowest prices using world #1 online, BullionVault...

Email us

Email us